There can be little debate that the world is more interconnected than ever. Evidence can be found in the simple act of contemplating a typical breakfast: coffee that originated in the mountains of South or Central America; perhaps a bowl of cereal made from grains grown in the American Midwest; and perhaps orange juice or avocado toast made from fruit grown in Mexico. You might even check the news headlines while you’re eating, possibly using a smart phone assembled in Taiwan. Dressing for work, you might choose a shirt made from Egyptian cotton and then drive to the office in a vehicle manufactured in Germany, Japan, or Korea.

As consumers in other words, most of us don’t give a second thought to the benefits of exposure to international products. In fact, this is why tariffs have been in the news so much recently; as American consumers we are long accustomed to using products that originated somewhere else on the globe.

But when it comes to investing internationally, many have an instinctively cautious reaction. And certainly, there are certain risks that go along with investing in non-US equities and fixed income: currency risk, regulatory risk, different taxation treatment, and—especially in the case of certain developing markets—political risk, to name a few.

On the other hand, some exposure to international investments can also work to dampen portfolio volatility over the long term. Since different markets around the world do not all respond the same way to the same international economic and other variables, some may outperform others in a given period. By seeking available gains across the broader spectrum offered by international investing, investors may achieve greater diversification than that possible when confining holdings to domestic assets.

Trying to Pick the Winners

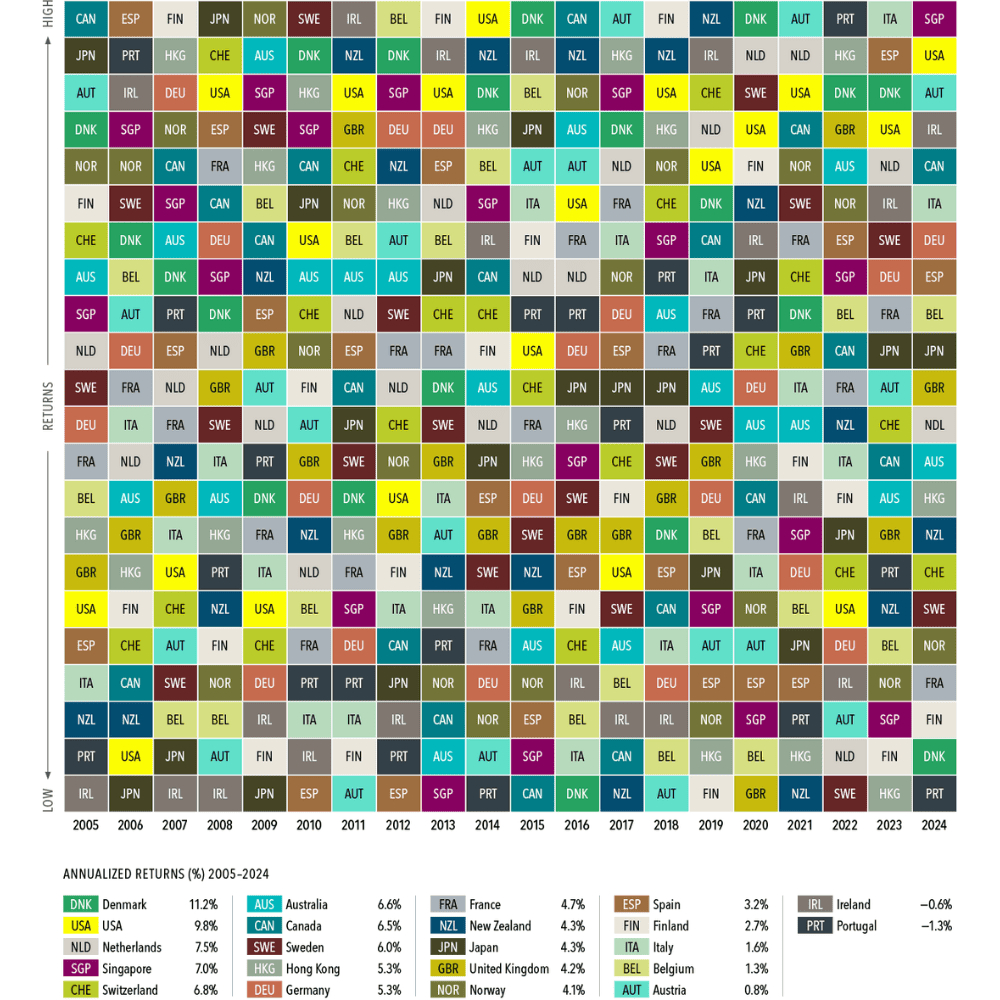

While the US does represent 65% of world market capitalization in equities, that still leaves more than a third of available opportunities untested when choices are limited to only US stocks. The US equities market is not the highest-performing choice every year. Consider the following graphic:

SOURCE: Dimensional Fund Advisors. Past performance is no guarantee of future results; indexes are not available for direct investment.

The chart illustrates the net returns of MSCI equity indexes in various developed markets, net of dividends, for the period 2005–2024. US equities markets outperformed all others in only one of these years: 2014. For each other year, the equities market in some other developed nation achieved the best performance.

Keep mind that this chart displays results from individual countries. Taken in the aggregate, international investments have tended to lag the S&P 500 over the last several years.

Nevertheless, reviewing these results leads to the observation that exposure to the available equity investments in other countries could permit investors to achieve improved gains in years when better growth is being experienced in economies other than that of the United States. It also suggests that trying to choose the “winner” in any given year would likely be difficult, if not impossible, for sophisticated investors, given the lack of any apparent pattern of outperformance by particular nations. This latter aspect strongly supports the wisdom of broad diversification, including not only exposure to varying industry groups, market capitalization categories, and growth profiles, but also to international asset groups. It may be further noted that while international investment returns as a whole have lagged those available in the US, it is impossible to predict how long the trend—or any trend in the financial markets, for that matter—will persist. In fact, thus far in 2025, international markets have outperformed, and analysts note that many international equities may be more favorably valued than their US counterparts. Thus, investors may be well advised to take advantage of the diversification offered by measured exposure to opportunities beyond the borders of the US.

It may also be useful to remember that a country’s size, population, or gross domestic product doesn’t necessarily tell us much about the investment opportunities in that country. Japan, for instance, is relatively small in landmass but accounts for 5% of the world’s equity market value—representing over 2,400 companies, including familiar names like Toyota and Sony—as well as 10% of the investment-grade bond market. Even a tiny country like Switzerland is home to publicly traded giants like Nestlé and two of the world’s biggest pharmaceutical firms.

Getting Started

One of the principal complications that investors could encounter when they want to incorporate international assets into their portfolios is the practical problem of executing purchases for assets that are not US dollar–denominated. Fortunately, there are ways for US investors to accomplish international diversification with a relative degree of convenience.

- American depository receipts (ADRs) represent shares of ownership in foreign corporations but are traded in the US on listed or over-the-counter (OTC) exchanges.

- Global ETFs and mutual funds allow investors to purchase dollar-denominated shares of funds holding many different international equities. Such funds may specialize in developed markets (Germany, the United Kingdom, Japan, etc.), emerging markets (Vietnam, China, India, Brazil, etc.), or other specialized areas of international focus.

What about fixed income?

The benefits of foreign investing limited to stocks. As of December 31, 2024, the US fixed-income markets accounted for only about 41% of the world’s investment-grade (rated BBB- or better by Standard & Poor’s) bond market. Germany, the United Kingdom, Japan, and other nations offer additional opportunities for those seeking better total returns on the more conservative portions of their portfolios.

Conclusion

By looking outside their home market, investors may be able to expand their choices and opportunities for higher expected returns. A global approach can also enhance diversification, which may help reduce portfolio risk and volatility. This isn’t guaranteed to produce strong returns every year, but it can deliver more reliable outcomes over time, helping investors stay on track toward achieving their long-term goals.

If you have questions about international investing and how it might fit in to your portfolio, don’t hesitate to reach out to your Rothschild advisor today.

Rothschild Wealth, LLC, an SEC-registered investment adviser, and Rothschild Investment, LLC, an SEC-registered investment adviser and broker-dealer, member FINRA/SIPC, are affiliates and are collectively referred to as Rothschild Wealth Partners™. Founded in 1908. Information is provided for informational purposes only, is not investment advice, and should not be relied upon as a recommendation. Past performance is not indicative of future results.