Get Started With Our Team of Advisors

No matter what stage of life you are in, you will always look towards the future. You may even ask, “What will retirement look like for me?” or “Will I have enough money to put my kids through college.” Sometimes, it takes time to figure out where to start! Let’s schedule some time to connect with a team member to help you find your footing, whatever your financial goals may be; a sound financial plan can help you live a satisfying life today and into the future.

Fill out the form below and provide any important details we should consider during our initial conversation. A member of our team will review your information and reach out to you to find a time to meet that works for you.

More Ways to Connect With Us

Are We The Right Fit?

You might not fit exactly into one of these buckets. You might fit into parts of all of them. We know no two situations are alike. There’s no one with your same financial needs, goals, and challenges.

That’s why our whole job is to get to know everything we can. Because you aren’t a case study. You’re just you.

On My Way

On My Way

These clients are...

- Rising professionals accumulating wealth

- Managing debt while planning future expenses

- Cautious investors seeking long-term financial success

How Did I Get Here?

How Did I Get Here?

These clients are...

- Successful professionals with unexamined accumulated wealth

- Juggling assets across multiple accounts

- Nearing retirement, seeking strategic financial planning

I've Made It, Now Don't Lose It

I've Made It, Now Don't Lose It

These clients are...

- Wealthy retirees with sufficient assets

- Market-cautious, aware of longevity and inflation

- Seeking low-risk, tailored investment strategies

Too Wealthy (For the IRS)

Too Wealthy (For the IRS)

These clients are...

- High net worth facing potential tax challenges

- Seeking wealth transfer and philanthropic strategies

- Aiming to minimize their heirs' tax burden

Looking For Something Unique and Creative

Looking For Something Unique and Creative

These clients are...

- Investors seeking unique investment opportunities

- Desiring complementary strategies to an existing portfolio

- Interested in alternative and structured investments

Life Has Changed

Life Has Changed

These clients are...

- Individuals experiencing major life transitions

- Adapting finances to positive and negative changes

- Seeking strategic guidance for new circumstances

I Hate Taxes

I Hate Taxes

These clients are...

- Tax-averse individuals seeking reduction strategies

- Collaborating with accountants for creative solutions

- Using gifting, harvesting, and philanthropic tools

I Am Too Illiquid For the Big Firms

I Am Too Illiquid For the Big Firms

These clients are...

- Successful but illiquid professionals overlooked by banks

- Seeking attentive, respectful wealth management services

- Poised for increased future financial liquidity

Building a Legacy Beyond My Business

Building a Legacy Beyond My Business

This client is an entrepreneur or head of a small to mid-size family business who understands that quality financial planning is essential for them, their family, and their employees. These clients need a trusted partner to advise them on qualified and nonqualified retirement plans so their employees can grow. And when it’s time to move on or monetize the sweat equity they’ve put into their business, we’ll walk with them every step of the way through custom succession, transition, and exit plans. With Rothschild Wealth Partners by your side, these clients can confidently focus on other important areas of running their business.

These clients are...

- Entrepreneurs and family business owners seeking integrated financial planning

- Looking for guidance on employee retirement plans and business growth strategies

- Planning for business succession and maximizing value in preparation for exit

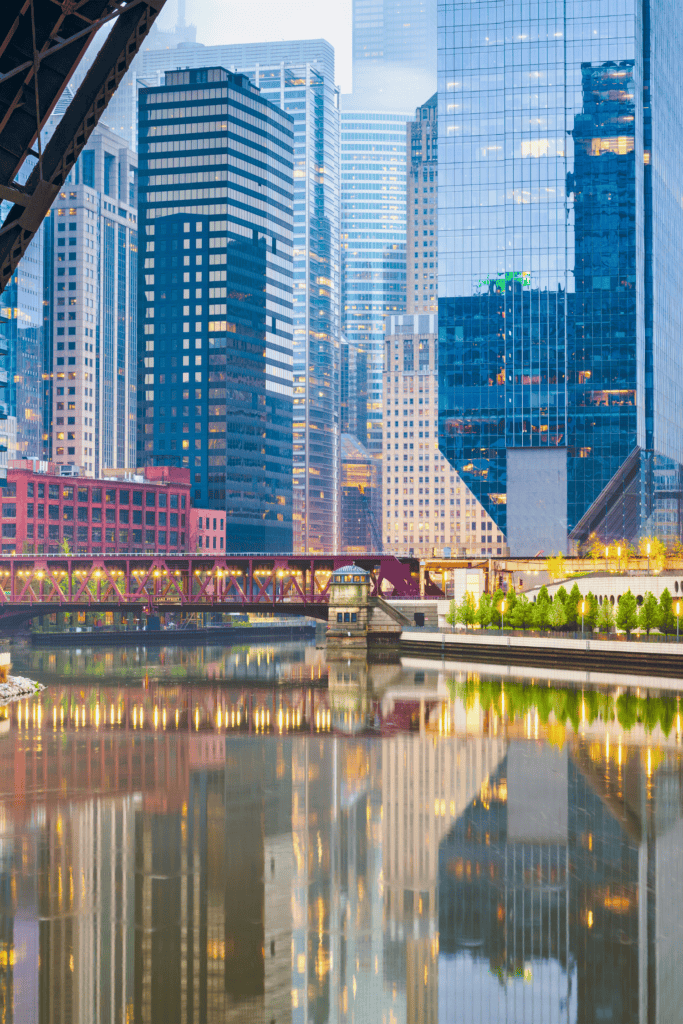

Serving You Where You Are

We believe in meeting you where you are, literally and figuratively. Our locations in Chicago and the surrounding area, combined with our remote capabilities, allow us to provide personalized financial guidance no matter where you’re located.